Many of us get interested in real estate after we have children.

However, not enough of us take advantage of using our dependents to lower our taxable real estate income.

Since I don’t want to get into trouble by offering tax advice, let me just recount my story and drop some overt hints. But first let me give credit to Al Aiello, CPA, MS Taxation for opening my eyes. I met him at Jeffrey Taylor’s 2014 Mr. Landlord Convention in Nashville, TN (which was an awesome event).

Check Out IRS Publication 929

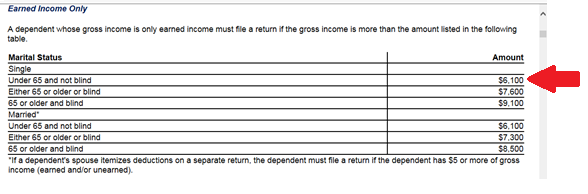

I want to direct your attention to what the IRS says about “earned income” for your children. Publication 929 provides guidance for “Earned Income Only”

That link takes you to a table that specifies that your non-blind dependent can earn up to $6,100 without having to pay/file taxes. That’s the 2014 limit which tends to go up each year.

Using the Information

I’m a big time believer in teaching my children about financial literacy and teaching them how to run our landlording business. So I was excited to learn that the IRS indirectly rewards you for training your children. Let me show you how on-the-job training creates tax deductions for landlords.

Instead of giving my 11 year old daughter an allowance, I’ve hired her to work for our rental business. Her duties include:

| Duties | Hours per Month |

| Proof Reading | 4 |

| Lite Landscaping | 4 |

| Office Cleaning | 5 |

| Video Editing | 3 |

| Research | 8 |

| Filing | 4 |

| Assist with tenant turnover | 5 |

| Litter pick up | 2 |

| Total | 35 |

For 2014, we’re paying her $14/hour so she racks up $490/month ($5,880 per year).

HINT: You can always pay your child to be a model in your advertisements. I’m sure they are just as adorable as any professional model.

OK, so we’re paying her less than the $6,100 limit and we are in compliance with IRS guidelines.

Open a Joint Account

I’ve opened a checking account for my daughter with my wife and I as joint owners, and each month we transfer her payments into it. I suggest being formal about the paper trail. Then we use the money from her account to pay for her expenses (just like normal) and contribute to her college savings (just like normal).

Please read that last sentence a few times. Let it sinks in.

At the end of the year, my LLC will report a $5,880 tax deductible expense for “Administrative Services” and according to the publication, my daughter won’t need to file at all.

The Savings

This deduction flows to my 1040. Assuming I’m in the 30% tax bracket, this strategy leads to a $1,764 tax offset.

Check with your tax preparer to see if you can do something similar. Don’t be afraid to read and use the tax code.

The Results

The IRS allows you to correct your last three years of tax returns, so I tried to amend my return from three years ago. I wasn’t paying my 11 year old as much back then, but I figured I was due a $200 refund. I was paying her out of my business account, so I sent the IRS proof and they agreed.

Today I received my first overpayment refund. Now I plan to go after refunds from the past two years.

Some Warnings

A more complete discussion of this strategy’s down side is available to subscribers. So go ahead and subscribe – it’s free.

However here’s a short list of things to beware of:

1 – Don’t loose your morals. There are plenty of legitimate ways to use this tactic. Be ethically creative.

2 – This expense might negatively affect your commercial property’s appraised value.

3 – If you completely shelter your income with this strategy you may draw unwanted attention.

4 – Make sure your documentation is thorough; don’t be lazy.

Now that you know, what will you do with this information?

Thanks for elaborating on this. When my 2 year old daughter gets older, I’m definitely going to give this a try.

As you said, it’s so important to ensure that we don’t go overboard on this – not only for ethical reasons, but also not to damage the relationship with our children.

A little work will teach them discipline, but a lot of work will make them bitter. After all, they are kids!

Mr. Hall, thank you for chiming in. Always an honor.

Al, thanks for this great blog. I have started thinking about hiring both my 11 year and 14 years as part of my REI plans. I heard this very concept after reading Robert Kiyosaki’s CPA’s book (Tax Free Wealth by Tom Wheelwright). Tom Wheelwright stated he takes family trips and writes-off the plane and hotel fairs–if his family spends at least 4 hours on their vacation on real estate searching,etc.

Thanks, again. Excited to hear of your blog. =)

Thanks for the reference Les. I’m going to go plow through that book now.

Fantastic information. I plan to use it in the future with my kids once I acquire my first property. I’m currently managing a friends properties and he has three kids. I plan to share this with him and see if you wants to put them to work for this tax deduction. Recently signed up as a member and love the information you’re prociding!

Hey Richard. Thank for your comment. Welcome to our community!