In a recent subscriber survey, you told me you wanted to know more about how to reduce monthly expenses. So, I’m starting a new challenge.

In a recent subscriber survey, you told me you wanted to know more about how to reduce monthly expenses. So, I’m starting a new challenge.

The goal is to come up with ways to reduce my monthly expenses by $100 per month without my tenants feeling it. Yep, this is the flip side of the $100 Income Challenge.

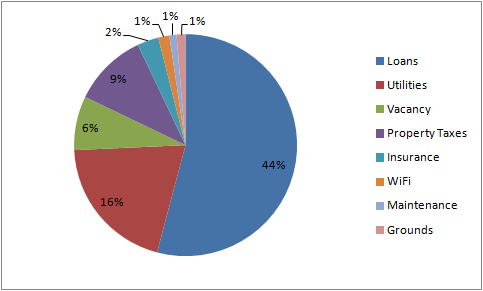

The pie chart shows my 8-plex’s monthly expenses that currently take up 80% of my $4,764 gross monthly rental income. My goal is to break down each group and find innovative ways to save.

With your input, I bet we can create a long list of ways landlords can reduce their monthly expenses by $100 each month.

Throughout 2013, I will apply the best tactics and technologies I can find to accomplish the mission. Yes, I’m going to spend real money – and hopefully not lose it.

I’m counting on the Leading Landlord community to pull me though. Will you help me?

Is the electricity on individual meters? If not, the building can be rewired with separate meters for each apartment. If the current electrical service is less than 75A per unit, the building should be upgraded anyway. Some lenders and insurance companies require it.

If it’s already upgraded, then you can submeter the electricity for a much smaller investment. There are services that can do this for you, but there are also do-it-yourself meters available, such as the Efergy at about $100 per unit.

Yes, submetering is already in place. Thanks for the tip. I only pay common area expenses.

Hi Al

This may be a very simple idea, but how about a refinance? The big blue blob on your pie chart is debt service and reducing that even a little bit will give you more bang-for-the-buck than anything else.

I’ve been looking at that with one of my rentals and the savings will net me over $200/month. And that’s on a pretty small loan compared to yours. It does of course depend on the current rate that you’ve got.

Here’s another idea: Reassess your property value and see if you can save on your taxes. I haven’t been able to do that with any rentals, but I applied for a reduction on my primary and saved about 700 per year. Not quite 100 / month, but it helps.

Jason, you’re absolutely correct. Those are big money savers. I’m going to add them to the list I’m compiling. We’ll dig into it when we deep dive into refi and reassess. Thanks for your input.