In 2018, I realized I was in Little League.

I’ve been so focused on net income that I overlooked margins.

Investors think in terms of rates of return (ROI)… how much things cost.

Arbitragers think in terms of margins… costs don’t matter.

Both approaches are important, but very different.

The Process for Abundance

It is so obvious in hindsight.

But I want to share my revelation anyway…

Here it is…

If you know how to create net income, then you can quickly create abundance.

Ta Da!!! That’s it. That’s really all there is to it.

No excuses or prerequisites.

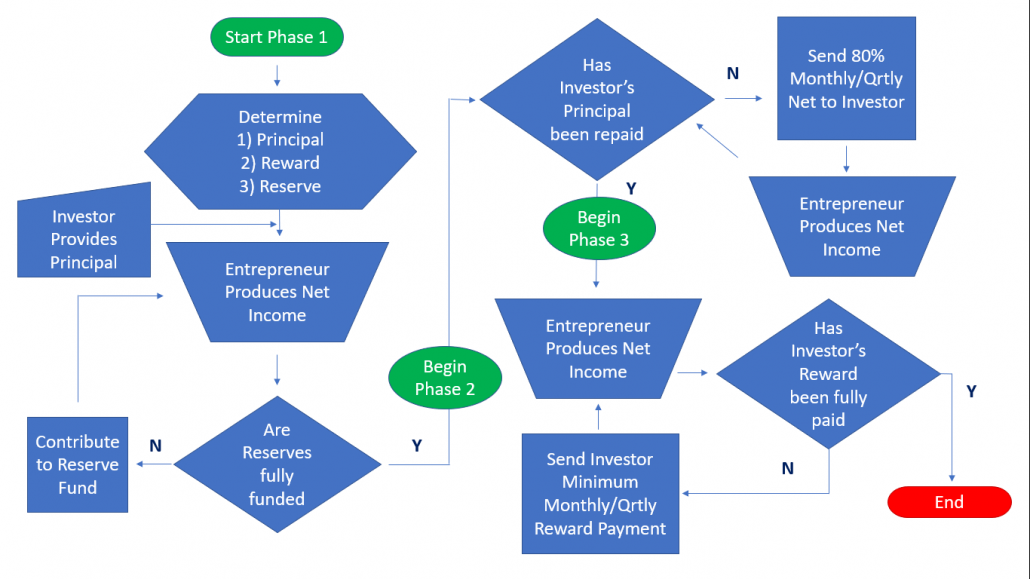

Here’s a diagram of the process. It’s an rental arbitrage business plan, but it works for other enterprises as well.

Rental Arbitrage Business Plan

This is a funding plan for your rental arbitrage business.

It shows how an entrepreneur can work with an investor to fund an enterprise.

Here’s a video that walks you through the whole thing.

Your Ability to Create Net Income

One of the easiest ways to create net income is to capture the difference between the hotel and rental markets.

But here’s the thing, when you go to learn how to drive a car, you enroll in drivers training. Then you get time behind the wheel with an instructor at your side.

If you skip these steps you increase the odds of someone getting hurt.

So it is in the world of arbitrage.

Before you head off to arbitrage someone else’s money to arbitrage someone else’s property you need to get some training. If you don’t you’ll likely make a lot of costly mistakes and may possibly end up worse off than when you started.