It wasn’t my original intent to embark on creating a vacancy reduction plan, but the need became obvious while I was trying to pick a fight with Ankit Duggal over his BiggerPocket’s article. In his article, Ankit discusses two classifications of expenses: verifiable and non-verifiable. He goes on to suggest you should focus on the verifiable expenses because they can boost your capitalization rate evaluation and help your rental appraise higher. Ankit is a smart guy; you should check out his article.

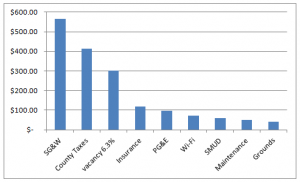

Although I agree 100% with his premise and plan to adopt his framework here on this blog (thanks Ankit) I was inspired to make my own evaluation to compare the benefits of reducing expenses for cash flow improvement vs. property value improvement. The graph above shows my 2012 monthly expenses sorted from largest to smallest, less mortgage.

Confronting the Brutal Facts

What jumped out at me as I was preparing a “long tail” argument was that my top two expenses (totaling $979) were nearly equal to all the others (totaling $740). The top two (sewer-garbage-water and property taxes) have already been considered in my cost reduction journey. In my situation, I’m not able to reduce these expenses further. That left me looking face to face at my vacancies. What could I do to vacancy-proof my apartment complex? Why should I accept vacancies as something I have to live with?

You might agree that I did pretty well in 2012 with only a 6.3% vacancy rate but this year is a different story. I’m currently in the midst of a perfect storm with 3 out of 8 units vacant (or non-paying) for several months. This year’s cash flow reminds me of how dependent I am on tenants and why I originally started this blog. I wanted, and still want, to be free of the Vacancy Monster!

Victim of Vacancies – Time to Declare War

As we continue the theme of expense reduction, we’re going to begin a new series on developing a vacancy reduction plan. Maybe we’ll end up figuring out how to create a waiting list or develop some tools to get my 2014 vacancy rate down to 0%.

My plan is to:

1 – Do a round up of information on the internet

2 – Interview some Leading Landlords to get their #1 tips

3 – Collect and organize your suggestions

We should end up with a great resource that we all could use. We should organize ideas into three categories:

1 – Things to do while 100% occupied

2 – Things to do once you get at 30 day move out notice

3 – Thing to do to quicken lease up

If you have some suggestions or tips, please leave them in the comment section below.

You might also want to read:

Reduce Your Vacancy Rates – 8 Step to Minimizing Turnover and Expenses

What a great idea! I’d love to learn what you glean in these areas:

1 – Things to do while 100% occupied

2 – Things to do once you get at 30 day move out notice

3 – Thing to do to quicken lease up

I don’t have anything at the moment to share, but I will certainly ponder this!

Most sincerely,

Pam Riordan, MA

Hi Pam,

1 – When I’m fully occupied I make sure my complex stays spotless. I like going the extra mile in good times.

2 – Once I get a 30 day notice, I start advertising for a replacement tenant and incentivize the departing tenant to help me do showing and land a new tenant before they move out. They get $100 if we find a replacement and $10 fee for cleaning up before we do a showing.

3 – Oh, quickening lease up is too big of a topic to tackle here.

Hope those tips get you thinking. Thanks for chiming in.

When my rentals are 100% occupied, I work on sprucing up the exteriors. Painting, landscaping, and general tiding up can do wonders come rent-increase time.

George Lambert

Author, What You Must Know BEFORE Becoming a Greedy Landlord. How to build a portfolio of investment properties for an income that lasts a lifetime.