We’re going to rethink how to estimate our real estate investments using the Monte Carlo Method. In this lesson we’ll look at the math used to estimate the profit from renting out a house for one year.

Once you’ve finished the last lesson in this series, you’ll understand how to use Monte Carlo simulations to determine the odds of breaking even and the likelihood of making a specific profit (among many other super useful things).

After this eCourse, you’ll know how to modify the spreadsheets you currently use to take advantage of Monte Carlo simulations.

Let start our demonstration by working with a very basic equation.

Step 1: Write the equation.

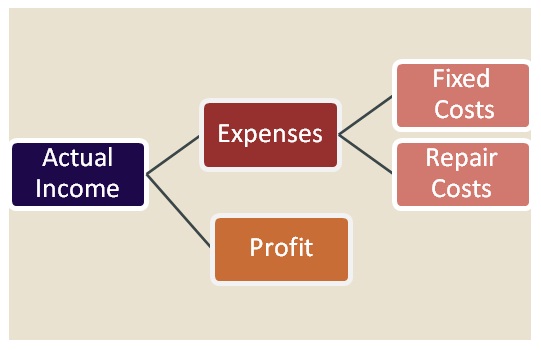

Profit = Annual Income – Annual Expenses

Step 2: Add more detail to the equation to highlight the estimated values from the known values.

For example:

Income = #months rented x monthly rent

Expense = fixed costs + repair costs

Step 3: Put it all together. Our equation now looks like this:

Profit = [# months rented x monthly rent] – fixed costs – repair costs

The main point: Previously, you may have made an educated guess at values for the “# months rented” and possible “repair costs.” But, if you’re working with your own hard-earned money, wouldn’t your rather start your thinking process by using a range of possible values? Working with ranges is just a smarter way to do business.

In tomorrow’s lesson I’ll show you how to get set up to do the math with ranges.

Proceed to the next lesson >>