Let’s talk about the elephant in the room.

Many Airbnb hosts are facing strict city ordinances and licensing requirements that oppress their ability to make extra income. You may be one of them.

But there’s still hope. You may be able to take home the same above-market income by providing Airbnb long-term rentals.

But first a note of clarification:

My suggestions are only for landlords who don’t share their primary residence with Airbnb guests. This is for stand-alone rentals that you plan to convert to a short-term rental. This is not for people who share the guest rooms in their homes.

Why you should consider Airbnb Long Term Rentals

There’s a certain level of hassle that comes with hosting short-term renters that you don’t get with long-term tenants.

The extra income makes it worthwhile but you have to consider the costs associated with short-term renting.

A typical landlord can expect to increase their net income by >30% if they operate a short-term rental.

While the extra income is enticing, it is definitely a job that requires lots of preparation and follow up work.

There are critical pre- and post-booking tasks that you need to be aware of. They require your time and you need to stay on top them to be an excellent host.

So, for the sake of our analysis, let’s assign a cost to these minor yet essential tasks. That way we can compare apples to apples.

Comparing 3 Short-Stays/Month with 1 Month-Long Rental

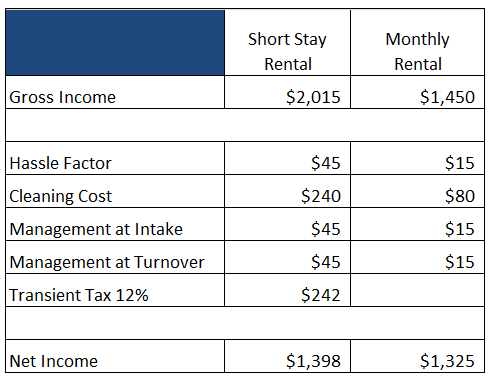

When we calculated the costs, they looked like this:

As the above table shows, even though the short-stay gross revenue is $565 more, the net income is nearly the same as the monthly rental. How can that be?

Most short-term rental discussions emphasize the higher gross income since it’s a sexy topic. It’s fun to talk about big, impressive numbers.

However, if you’re bold enough to face the facts, read on.

From a net income perspective, those who’ve imposed city or local ordinances that we dislike so much, might actually be doing us landlords a favor.

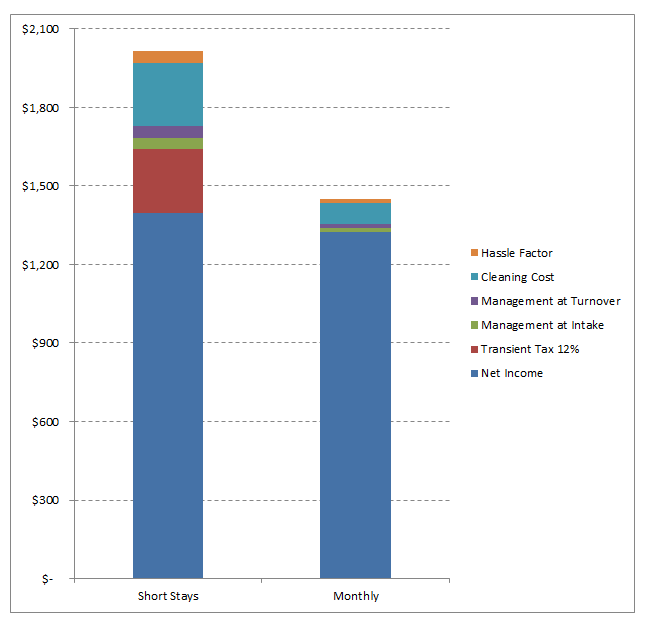

Let’s Chart Out Each Component to See the True Picture

From this view we can see there are a bunch of expenses in both columns. And those expenses look confusing.

Let’s drill down and take a more granular look at each one.

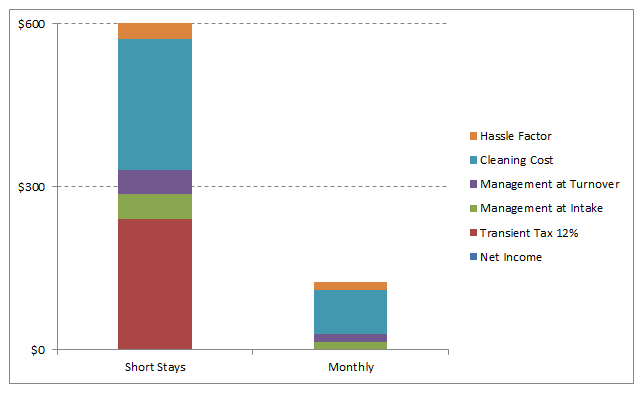

Let’s Take a Closer Look at Expenses

I admit, not all expenses associated with hosting a short term rental are shown. I have only included standard expenses that are typical of each stay.

What you see in the graph below are five expenses that vary against each other

Hassle Factor

There’s always a bit of worry in your life when you self-manage a rental. Even when your tenant is on a one-year lease, there’s always a worry in your mind.

This nagging feeling, that I call a hassle factor, gets exasperated when you manage short-stay guests. There’s always a chance that something will go terribly wrong… just as you head off to your child’s violin recital.

This hassle factor needs to be included in the equation – because it’s real. And while we can all absorb this irritation once in a while, when you have frequent turnovers, it becomes a real burden. I equate the Hassle Factor to 30 minutes for each guest stay. Therefore if you host multiple guests per month you can expect more hassle – and more expenses.

Note that I use a $30 per hour wage in this example.

You can’t ignore the Hassle Factor; you’ll draw incorrect conclusions if you do. You simply have to pay yourself because your time has value.

Cleaning Cost

This is another expense that really highlights the differences between both operating modes. It’s obvious, but I’ve got to say it. If you have frequent move ins, then you’ll have more cleaning costs. Even if you do the work yourself, your time has value. You have to factor that cost in.

The fewer move ins you do per month the less chance you’ll have of your cleaner dropping the ball. And that helps reduce the chance of your guest walking in on an 80% clean rental and leaving a bad review that lingers online for a long time and hurts your future sales.

Intake and Turnover Management

Each time you have a guest you’ll need to correspond with them to answer their questions. It’s the beginning of a great guest experience that helps you obtain a great reviews. When you have fewer guests per month, this work is less taxing. You’ll be able to give each person a VIP experience that leads to top notch reviews.

Transient Tax / Lodging Fee

Many cities are adopting laws requiring Airbnb landlords to collect lodging fees for stays less than 30 days. I’ve seen these fees range from 10% to 14% per day.

The bad news is that your small business is getting gouged again. The good news is that these regulations proves your city thinks your short term rental business has a viable future.

Taxes and fees are really the biggest difference between the two operation modes. If you operate Airbnb long term rentals, then you’re operating as a traditional landlord. “Tourist Taxes” don’t apply to you. That’s a HUGE benefit.

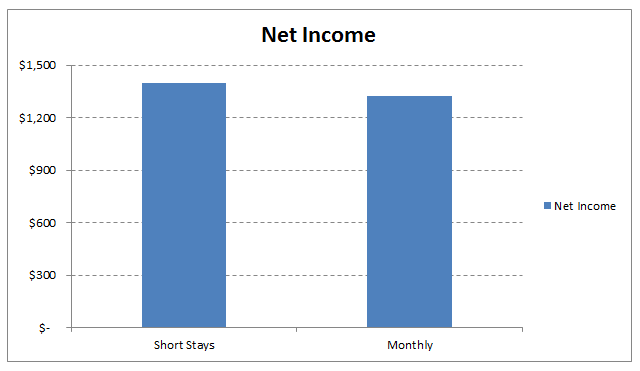

Now Let’s Take a Look at Net Income

Net income, the amount that remains in your bank account after the expenses are paid, is the bottom line. This is the basis for our business decisions. As this graph shows, from a net income perspective, there’s not much difference in the two modes of operation.

If you can earn nearly the same net inome by offering monthly rentals, then you have two viable options to choose from. And if your city regulations prohibit offering short-stays, then specializing in Airbnb long term rentals may be a great option for you.

You can net nearly the same amount providing monthly rentals as providing frequent nightly stays.

Comparing Traditional to Monthly to Weekly Rentals

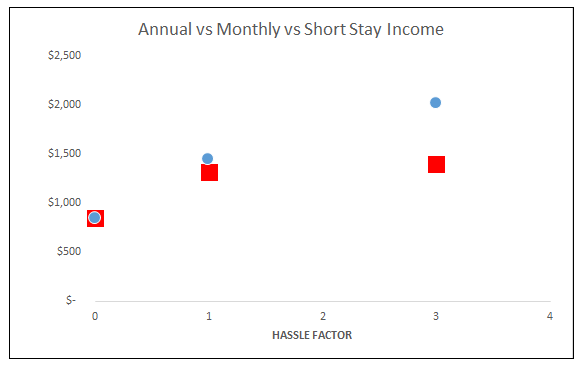

In the graph below, the blue circle represents gross income and the red square represents net income.

First, at a Hassle Factor of zero, I plotted the traditional landlord gross and net revenue. In the traditional mode, the gross and the net are the same $850.

Next, at a Hassle Factor of 1, I plotted our monthly gross and net income, represented by a blue circle and red square respectively.

Lastly, at a Hassle Factor of 3, I plotted our gross and net when a rental is operated in a short-stay mode. Again, this assumes you host three guests during the month.

“Monthly Rentals” are the Obvious Winner

When you consider the hassle-factor and the amount of work required, it’s becomes clear that, whenever possible, operating an Airbnb long-term rental is the better option. It requires less time and worry.

But getting monthly renters isn’t as easy as it sounds. Airbnb long term rentals are certainly easier to operate in some cities than others. Overall, a different type of advertising and new strategies are required.

That’s where Extended Stays for Landlords come in. It’s a practical and easy-to-understand course that walks you through the process of setting up an Airbnb long-term rentals and marketing it in a way that attracts business travelers.

TAKE AWAYS

Whether you’re facing local ordinances or not, you should consider operating your short term rental in a 30-day and more mode. It might be the “Holy Grail” for your rental market.

Yes this is a simple concept but it’s a little tricky to implement.

You have to adopt a different mindset to operate monthly rentals.

You have to use different marketing techniques and rely on different booking strategies, but you can learn these skills. And they are very much worth learning if you really want to earn the maximum income from your property.

Check out Extended Stays for Landlords , the highly-sought after course that helps landlords transition into short-term rentals. It leads the industry as the best tool for rental owners. The materials and coaching found in this course make it easy for you get set up to operate a monthly rental that caters to Airbnb guests.

, the highly-sought after course that helps landlords transition into short-term rentals. It leads the industry as the best tool for rental owners. The materials and coaching found in this course make it easy for you get set up to operate a monthly rental that caters to Airbnb guests.

Click HERE to get started.

Follow these links to read learn more lucrative landlord ideas:

Leading Landlord provides passive and residual income strategies and ideas for landlords, property managers and asset managers.